Report of the

Board

of Directors

to the Shareholders’

Meeting

GRI 2-22

Liverpool Tijuana

El Puerto de Liverpool celebrated its 175th anniversary strengthening its capacity for innovation, growth, and profitability.

The successful development and implementation of the various initiatives of our ecosystem in terms of logistics, omnichannel and Customer service has been fundamental to achieve greater satisfaction and service level for our Customers. All this, with a solid financial structure in terms of revenues, profitability, and balance sheet.

Our consolidated revenues were 16.6% higher than the previous year, totaling $176,034 million pesos.

In the Commercial segment, our revenues grew to a total of $159,112 million pesos, representing an increase of 16.3% compared to the previous year. In same-store terms, Liverpool grew 16.4% and Suburbia 9.0%.

During the year, we observed a consumption recovery in Softline sales. By geographic area, the Southeast of Mexico and the Mexico City Metropolitan Area reported above-average growth.

Liverpool has been focused on offering our Customers a unique shopping experience. During the year, with the objective of offering the best service, we re-launched the “Sentido de la Experiencia” (Sense of Experience), reinforcing the “Sí Hay” (Yes, we have it). We have oriented our stores as experience, service, and procurement centers. Likewise, we continue to position Liverpool as the best ecosystem offering for general merchandise and value-added services, while offering our Customers solutions that generate value and ease their daily lives. This will increase their preference for us and differentiate us from our competitors.

In the Commercial segment, revenues totaled $159,112 million pesos.

33% of digital sales were delivered through Click & Collect modules.

At Suburbia, 2022 was a year of change, learnings and evolution. Significant progress was made in the main strategic initiatives, such as the updating of our own brands, the arrangement and signage of departments, seeking a consistent offer in all our locations, and Customer care. We strengthened our value proposition based on fashion merchandise at affordable prices. We continued to work on improving our stores’ image, as well as the checkout experience.

The Group’s total digital sales represented a 23% share, with total growth of 20% and Marketplace standing out with an increase of 54%.

33% of digital sales were delivered through the Click & Collect centers located in each of our Liverpool stores, Liverpool Express locations, and Suburbia stores.

We have identified operational efficiencies throughout the delivery process. Through our stores and distribution centers, we achieved 66% of deliveries to be within a maximum range of 30 kilometers, reducing delivery times by 31% and achieving logistical savings.

Merchandise and service options are displayed in a personalized way in our digital channels according to search and purchase behaviors.

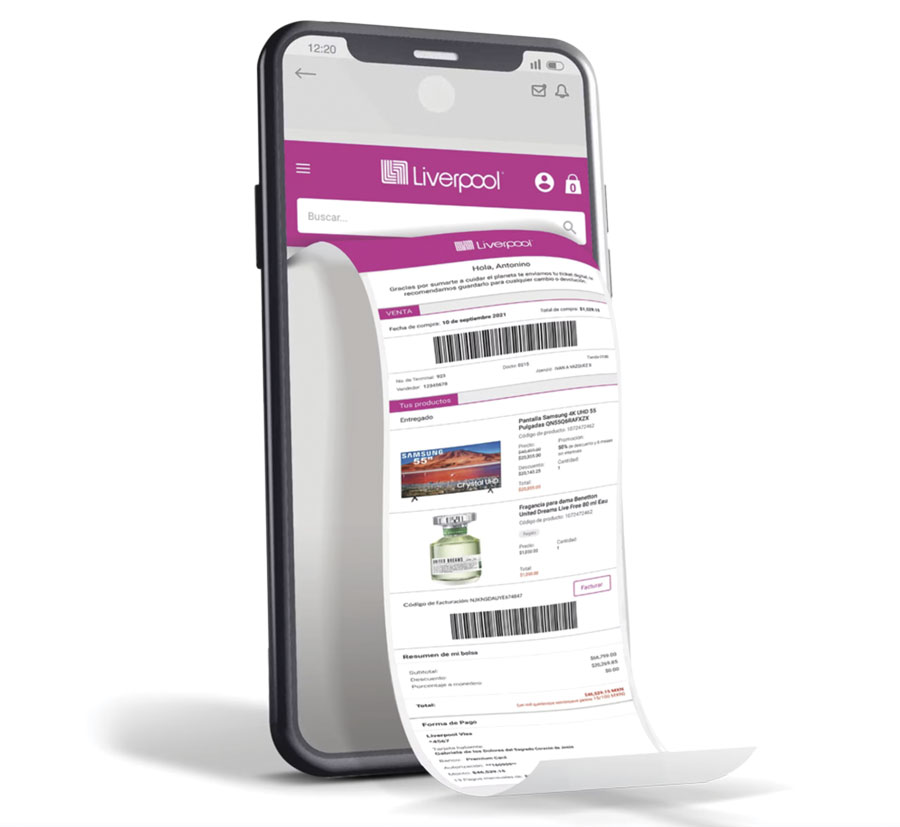

Our Liverpool Pocket App had a 36% growth in Active Users. It is a pillar of the omnichannel strategy and has become the most relevant app in terms of sales, transactions, and sessions. Our 1.5 million registered digital ticket Customers can consult all their transactions in this application.

We started the operation of the Single Customer Registry, focusing on security.

We launched the virtual credit card processing functionality with immediate approval and availability for use.

We served more than 13 million Customers through virtual platforms and by telephone. 70% through WhatsApp, social networks, and email, and 30% through our Contact Center - CAT Morelia.

Our Liverpool Pocket App had a 36% growth in Active Users.

PLAN - Arco Norte Logistics Platform

This year, we concluded the first stage of our new Arco Norte Logistics Platform (PLAN by its Spanish acronym) with the Big-Ticket unit starting operations. We now have the capacity to serve up to 70% more Customers with better service, integrating for the first time the processes of Liverpool, Suburbia and Boutiques for furniture and white goods.

The Financial Businesses division delivered an 18.5% growth in revenues. Our credit risk management achieved low levels of loan delinquency rate, ending the year at 2.4%. The past-due portfolio coverage ratio ended the year at 4.1 times. Following the growth strategy, Suburbia cards exceeded 1.3 million accounts at the end of the fiscal year.

Our Real-Estate division ended the year with an occupancy rate of 90.3%, slightly higher than at the end of the preceding year, indicating a 20.4% improvement in revenues.

The gross merchandise margin ended the year at 32.4%, an improvement of 1.1 percentage points compared to the previous year. In merchandise imports, there was adequate planning, which allowed us to have inventories in a timely manner. Thanks to operating expense control and healthy collections, EBITDA was $30,686 million pesos, an increase of 28.3% compared to 2021.

Net income totaled $17,385 million pesos, 35.1% above the previous year figure.

Real Estate ended the year with an index of occupancy rate of 90.3%.

At the year-end, we had a cash position of $24,516 million pesos as a result of good performance in sales and the quality of the loan portfolio. We paid in full the LIVEPOL 12-2 and 17-2 bonds for a total of $3,400 million pesos using our own resources.

We invested a total of $7,871 million pesos, 29% of which went to logistics projects, 33% to store openings, and 12% to IT projects projects.

Income taxes totaled $7,045 million pesos, an increase of 28.2% over the previous year. Other taxes retained and paid, taxes and import duties, as well as IMSS, SAR and INFONAVIT contributions, totaled $15,299 million pesos.

We invested a total of $7,841 million pesos, 29% of which was dedicated to logistics projects, 33% to openings, while 12% was dedicated to computer science projects.

We opened Liverpool Tijuana in Baja California and Mitikah in Mexico City, along with 15 new Suburbia stores.

Grupo Unicomer, a company dedicated to the commercialization of furniture, electronics, housewares, motorcycles, eyewear, and consumer credit in 26 countries of Latin America and the Caribbean, reported a $22.0 million dollars for the year and an EBITDA of $228 million dollars. Unicomer has 25 commercial brands and more than 13,000 employees.

For El Puerto de Liverpool, our employees are our priority. Therefore during 2022, we continued to strengthen their work experience with digital applications focused on: facilitating access to their benefits (vacations, loans, account statements); improving their physical and emotional well-being, with vaccination programs, disease prevention, mental health and quality of life. Likewise, we promoted the development of leadership, safety and integrity skills through asynchronous educational platforms that allowed them to go at their own pace.

We also strengthened our executive evaluation model by promoting talent development, with experiential plans at all management levels and improved variable compensation.

We opened Liverpool Tijuana in Baja California and Mitikah in Mexico City, along with 15 new Suburbia stores.

Liverpool Mitikah

Through the efforts made by the Company, and our commitment to ESG principles, El Puerto de Liverpool joined the Dow Jones Sustainability Index for the Latin American Integrated Market (MILA) and the Pacific Alliance, as well as the S&P / BMV Total Mexico ESG Index, thus serving all our stakeholders. We also obtained 1st place in the 2022 Corporate Integrity 500 (IC500) evaluation, conducted by Mexicanos Contra la Corrupción y la Impunidad for the second consecutive year.

Our Ordinary Shareholders’ meeting on March 10, 2022, declared a dividend of $2,282 million

pesos on the 1,342,196,100 shares representing the company’s capital stock. The Board of Directors set the payment dates for May 27 and October 14, both in 2022.

Our Annual Report continues to evolve, focusing on Sustainability. The documents and information are aligned with international standards such as SASB, GRI, TCFD and the SDGs (Sustainable Development Goals). This reflects the commitment held by El Puerto de Liverpool through its “La Huella” strategy, and our stated goal of becoming a zero-emissions company by 2040.

During 2022, the strengths of the organization and the operation were consolidated. In this environment of normality, our Customers found their satisfaction in omnichannel interaction through the channel of their choice. The company’s finances have once again shown their solidity, strengthening the Group’s vitality.

We would like to take this opportunity to express our deep gratitude to our shareholders, Customers, suppliers, tenants, and employees for their trust.

Sincerely,

The Board of Directors

Mexico City, December 31, 2022